The Dearborn Fire District was formed from the Wolf Creek and Cascade Rural fire districts in August of 1986. Ted Tholen led a coalition of community members willing to give land, money and time to create a fire district, build a fire hall and recruit volunteers to serve and protect the area.

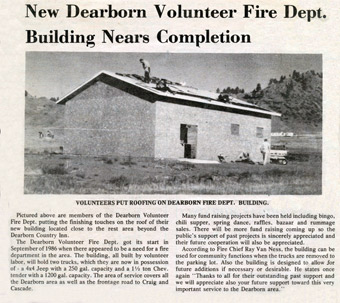

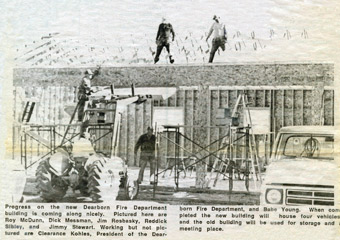

In October of 1986 land was donated by Woody Carrico, and construction of the fire hall began in July 1987, using all volunteer labor. In September of that year, Paul Keller presided over the official incorporation of the Dearborn Volunteer Fire Department. August 1988 saw the dedication of the fire hall with Darlene Cashman as President. Honored guests at the dedication were out-going President Paul Keller, Cascade Mayor Earl Damon, President of the Montana Rural Firefighters Association, Lyle Nagel, and Woody Carrico, who donated the land.

Dearborn Fire has changed over the years from a Fire District, to a Fire Company, and in 1995 was designated a Fire Service Area by Inter-Local Agreement between Cascade & Lewis and Clark Counties.

The primary responsibilities of the DFSA are:

The primary responsibilities of the DFSA are:

1. Provide prevention, protection and fire suppression to the homes and property of the owners within the service area.

2. Respond to vehicle accidents on Federal, State, County and private roads.

3. Assist when requested by medical responders.

4. Assist when requested by the County Search and Rescue.

The area served by the DFSA is located in the southern portion of Cascade County and northern most portion of Lewis & Clark County (Missouri River Canyon). There are over 720 homes/structures and businesses in our area largely owned by seasonal property owners (approximately 78%). The remaining property owners are retired or working full-time. During the last ten years, the DFSA has seen a dramatic 38% increase in the number of new homes. The Missouri River Canyon attracts thousands of tourists, fishermen and summer residents a year. In the next 5 years we expect more commercial buildings providing recreation, food services, rental homes and motel/hotel facilities. The total market value of the homes in our area is over $104,000,000.

The area served by the DFSA is located in the southern portion of Cascade County and northern most portion of Lewis & Clark County (Missouri River Canyon). There are over 720 homes/structures and businesses in our area largely owned by seasonal property owners (approximately 78%). The remaining property owners are retired or working full-time. During the last ten years, the DFSA has seen a dramatic 38% increase in the number of new homes. The Missouri River Canyon attracts thousands of tourists, fishermen and summer residents a year. In the next 5 years we expect more commercial buildings providing recreation, food services, rental homes and motel/hotel facilities. The total market value of the homes in our area is over $104,000,000.

These homes are located in the heavily forested mountains, canyons and along the Missouri River. Many of the mountain homes can only be accessed by 4-wheel drive vehicles and are adjacent to Federal & State wildlands. I-15 bisects the canyon and is the scene of numerous accidents requiring DFSA response. Consequently, our fire service area is a classic example of an urban-wildland interface area requiring different and diverse operational skill sets, equipment and vehicles. We have to be prepared to fight both wildland and structure fires. Responding to accidents, water rescues and other emergencies requires yet another set of skills and equipment.

How is the Dearborn Fire Service Area (DFSA) organized?

Dearborn Fire has been established as a Fire Service Area. A fire service area differs from a fire district only in how they are initiated and funded. A fire district can be established “if a petition in writing signed by the owners of 40% or more of the real property in the proposed district and owners of property representing 40% or more of the taxable value of the property in the proposed district.” MC 7-33-2101 A fire service area is established “upon receipt of a petition signed by at least 30 owners of real property in the proposed service area”

Dearborn Fire has been established as a Fire Service Area. A fire service area differs from a fire district only in how they are initiated and funded. A fire district can be established “if a petition in writing signed by the owners of 40% or more of the real property in the proposed district and owners of property representing 40% or more of the taxable value of the property in the proposed district.” MC 7-33-2101 A fire service area is established “upon receipt of a petition signed by at least 30 owners of real property in the proposed service area” MC-7-33-2401.

Fire districts are generally funded through a mill levy while fire service areas charge a fire fee. MC-7-33-2404 specifies that “the fee charged to owners of structures is intended to be primarily used for structural fire prevention and suppression.” A fee can be charged to owners of undeveloped land but the fee “may not exceed 15 cents an acre up to a maximum of $250.” MC-7-33-2404 also specifies that “the county commissioners or the trustees … may pledge the income of the fire service area to secure financing necessary to procure equipment and buildings to house the equipment.”

The Dearborn Fire Service Area was established by an Interlocal Agreement between Lewis & Clark and Cascade County June, 1995. DFSA reports to the Cascade County Commission who administers the fire fees received from both Lewis and Clark County and Cascade County DFSA residents. A volunteer Board of Trustees either elected or appointed by the Cascade Board of Commissioners manages the finances and sets policy for DFSA.

Fire districts are generally funded through a mill levy while fire service areas charge a fire fee. MC-7-33-2404 specifies that “the fee charged to owners of structures is intended to be primarily used for structural fire prevention and suppression.” A fee can be charged to owners of undeveloped land but the fee “may not exceed 15 cents an acre up to a maximum of $250.” MC-7-33-2404 also specifies that “the county commissioners or the trustees … may pledge the income of the fire service area to secure financing necessary to procure equipment and buildings to house the equipment.”

The Dearborn Fire Service Area was established by an Interlocal Agreement between Lewis & Clark and Cascade County June, 1995. DFSA reports to the Cascade County Commission who administers the fire fees received from both Lewis and Clark County and Cascade County DFSA residents. A volunteer Board of Trustees either elected or appointed by the Cascade Board of Commissioners manages the finances and sets policy for DFSA

How is the Dearborn Fire Service Area financed?

The DFSA is wholly financed by fire service fees assessed to property owners in their yearly property taxes. The following fire fee assessment table was approved by both the Cascade and Lewis & Clark County Commissioners July 22, 2017. This tiered fire fee is based on the taxable value of the property.

| Taxable Value Range | Fire Fee | |

|---|---|---|

| Tier 1 | $0 – $675 | $90 |

| Tier 2 | $676 – $1,600 | $165 |

| Tier 3 | $1,601 – $2,981 | $185 |

| Tier 4 | $2,982 & above | $200 |

Fire fees pay for the maintenance and acquisition of equipment, buildings, and administrative costs. Annual budgets; monthly budget status; and state financial reports are submitted to both Cascade and Lewis & Clark County.